Presented by Paystrubmakr.com By John Wolf and Tom Collen CPA Cents-per-Mile Valuation Method §61 Under the cents per mile method, the value of the benefits equals the product determined by multiplying the total number of miles the employer drove the car for personal purposes by the optional standard mileage rate. To use this method, the value of […]

Blog

Tax and Foreign Income, Low-Income Housing Tax, Military Allowances

Presented by Paystrubmakr.com By John Wolf and Tom Collen CPA Repatriation of Deferred Foreign Income A U.S. corporate shareholder of a foreign subsidiary generally is not subject to U.S. tax on the earnings of the foreign subsidiary until the earnings are distributed to the U.S. parent corporation (i.e., deferred foreign income taxation). The foreign subsidiary’s undistributed earnings […]

Self Employment Gig Workers Tax and CRP Payments §1402

Presented by Paystrubmakr.com By John Wolf and Tom Collen CPA Self-Employment Tax & CRP Payments §1402 For those who receive Social Security Retirement or disability benefits, any Conservation Reserve Program (CRP) payments are now exempt from the social security self-employment tax. IRS quote Note: Schedule SE and its instructions and Publication 225, Farmer’s Tax Guide has the details. Conservation […]

Read More about: Net Operating Loss Tax Deduction Modified

Presented by Paystrubmakr.com By John Wolf and Tom Collen CPA Small Employer HRA §9831(d)(2) A Health Reimbursement Arrangement or Account (HRA) is an IRS-approved, employer-funded, tax-advantaged employer health benefit plan that reimburses employees for out-of-pocket medical expenses and individual health insurance premiums. For 2018, HRA payments and reimbursements for qualifying medical care expenses of an eligible employee […]

About §199A deduction Qualified Trade Or Business

Presented by Paystrubmakr.com By John Wolf and Tom Collen CPA Qualified Trade Or Business A taxpayer can claim a §199A deduction for most types of businesses, but not for any businesses: (1) that involves the performance of services in accounting, actuarial science, athletics, brokerage services, consulting, financial services, health, law, or the performing arts; or (2) that […]

Read about: Net Operating Loss Tax Deduction Modified

Presented by Paystrubmakr.com By John Wolf and Tom Collen CPA Business Interest Limited Business interest generally is allowed as a deduction in the taxable year in which the interest is paid or accrued, subject to a number of limitations. For example, limitations on interest expense exist for certain amounts paid in connection with insurance and annuity contracts, […]

Small Business Personal Solar Property Credit

Presented by Paystrubmakr.com By John Wolf and Tom Collen CPA Personal Solar Property Credit §25D For property placed in service after 2005 and before 2017, §25D provided a personal tax credit for the purchase of qualified solar electric property, qualified solar water heating property, fuel cell plants (up to $500 for each one-half kilowatt of electric capacity), […]

Read about: Tax Paying Hope and Lifetime Learning Credits

Presented by Paystrubmakr.com By John Wolf and Tom Collen CPA Learning credits are essential to you, read about: Hope and Lifetime Learning Credits §25A Lifetime Learning Credit, §25A(a)(1) In 2018, the maximum amount of Lifetime Learning credit you can claim is $2,000 (i.e., 20% of the first $10,000 of qualified education expenses) per taxpayer return (§25A(c)(1)). The […]

Dependent Child, Care Expenses and more Tax Credit 2020

Presented by Paystrubmakr.com By John Wolf and Tom Collen CPA Child Tax Credit §24 Under §24, an individual may claim a tax credit for each qualifying child under the age of 17. A child who is not a citizen, national, or resident of the United States cannot be a qualifying child. The amount of the credit per […]

About Tax and Marriage Penalty, Mostly Gone 2018 to 2020

Presented by Paystrubmakr.com By John Wolf and Tom Collen CPA Since 2012, the size of the regular income tax rate brackets for a married couple filing a joint return are generally twice the regular income tax rate brackets for an unmarried individual filing a single return. Note: The marriage penalty relief for the standard Deduction, the various […]

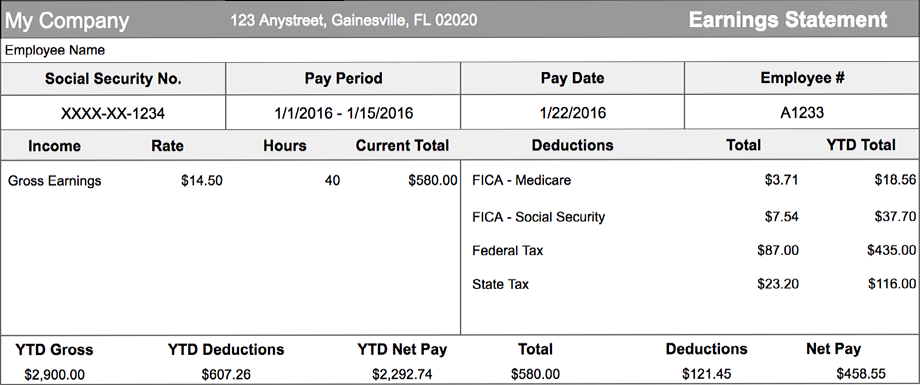

You can build your pay stub right now. It is an instant pay stub. A real check stub with your deductions and income. As soon as you provide payment, you can print it, download it and we'll email it to you just to make sure!

Make Your Pay Stub